Grain production is now expected to total 299.7 million tonnes, 20 million tonnes less than in the 2022/23 cycle

02/12/2024

The weather didn’t help, and as producers are already seeing in the fields, the 2023/24 grain crop will be smaller than originally expected. On Thursday, the National Supply Company (CONAB) again lowered its production estimate, mainly due to losses in soybeans and corn. The grain harvest is now expected to total 299.7 million tonnes, 2.2% less than the January forecast and 6.3% less than the 2022/23 harvest. That’s 20 million tonnes less between one crop and the next.

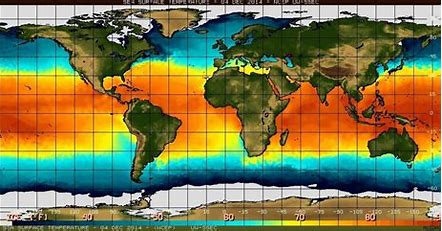

“The delay in the start of the rains in the Central-West, Southeast, and Matopiba regions, followed by irregular and poorly distributed rains, with records of summer rains lasting more than 20 days, as well as high temperatures, are having a negative impact on crop performance,” said CONAB in its 5th Crop Survey report.

The lack of rain and the high temperatures due to the El Niño climate pattern have damaged the soybean and corn crops of the first harvest since planting. Soybean planting has been delayed, which should also affect the second corn crop, according to CONAB.

Soybean production, the flagship of Brazil’s agribusiness, is now expected to be 149.4 million tonnes, 3.4% less than the previous harvest. Compared to the initial forecast of 162 million tonnes, this represents a 7.8% decline. Production of less than 150 million tonnes had already been expected by market analysts.

For corn, CONAB estimated total production at 113.7 million tonnes, 13.8% less than in the 2022/23 cycle. This figure includes three crops. “The first crop, which accounts for 20.8% of total production, faced adverse situations such as high rainfall in the south of the country and low rainfall in the Central West, accompanied by high temperatures,” CONAB noted.

The bean crop estimate fell slightly, but was still close to 3 million tonnes, taking into account the three harvests. In rice, although El Niño initially affected the crop, no losses are expected for the time being. CONAB estimated production at 10.8 million tonnes, 7.6% higher than the 2022/23 crop.

CONAB’s survey was not all negative. The country is expected to see a new record in cotton production, with 3.3 million tonnes of lint. According to the agency, the price and marketing prospects have stimulated an increase in plantings, which grew by 12.8% over the 2022/23 crop.

On Thursday, CONAB also released its first estimate for the winter crop, forecasting a harvest of 10.2 million tonnes of wheat. This figure is 26% higher than the 2022/23 crop. Planting begins this month in the Central-West and will gain momentum in mid-April in Paraná and in May in Rio Grande do Sul, states that account for 82.7% of the country’s wheat production.

With the updated soybean production estimate, CONAB also lowered its export forecast for this crop by 4.29 million tonnes to 94.16 million. Corn shipments were also lowered by 3 million tonnes. As a result, they should total 32 million tonnes.

On Thursday, the Brazilian Institute of Geography and Statistics (IBGE) also released a lower estimate for the 2024 grain harvest, but the drop wasn’t as significant as CONAB’s. The agency lowered its estimate by 1% to 94.5 million tonnes. The agency lowered its estimate by 1% to 303.4 million tonnes. Compared to last season, this represents a decline of 3.8%.

Contrary to Brazilian estimates, the U.S. Department of Agriculture (USDA) on Thursday projected a still robust soybean crop in Brazil for the 2023/24 crop year in its monthly World Agricultural Supply and Demand Estimates report. The agency’s forecast calls for production of 156 million tonnes, 1 million tonnes less than the January forecast.

Analysts had expected a more aggressive cut from the USDA of at least 3 million tonnes. Nonetheless, March soybean contracts on the Chicago exchange closed up a modest 0.38% at $11.9350 per bushel.

For Ronaldo Fernandes, an analyst at Royal Rural, the USDA failed to take into account the fact that 2023 was the hottest year on record and that soybeans developed under such conditions. “There is no productivity or acreage to justify a 156-million-tonne crop. Given that, the market knows that soybean production is much more likely to be below 150 million than above that volume,” he said.

(Paulo Santos and Rafael Rosas contributed reporting.)

*Por Fernanda Pressinott — São Paulo

Source: Valor International